Debt Healthy & Wise

Understanding how to use and manage debt wisely is critical to financial well-being. Starting conversations around loans and credit early on will help to instill healthy money habits. In this article there are ways for you as parents to discuss with ...

Sharing is Caring

Sharing is caring. In addition to the positive psychological and physical benefits of charity and giving, teaching children to be philanthropic can promote social responsibility and encourage compassion and empathy. In this article there are differen...

Needs vs. Wants

When children/grandchildren start thinking about that next set of purchases they have in mind they want to start saving for, don't miss this golden opportunity to discuss with them the concepts of needs versus wants and financial tradeoffs. As part o...

This Month We Celebrate Financial Literacy Month

April is National Financial Literacy Month! As part of TFO Life Academy’s objective to equip the future generation with tools for financial success, we will be posting a new article with suggestions for practical ways of teaching financial concepts...

Protect Your Information From Prying Eyes

As more and more consumers search for financial information on the Internet, they may inadvertently leave themselves open to being “tracked” by certain companies and individuals. Visitors to financial Websites have created a large mass of informa...

Calling All Newlyweds: How to Get a Financial Head Start

If you are newly married with no children, you may have a special opportunity to build your savings and investments. In this article, we outline four financial “I do’s” each newly married couple should consider.

What Job Seekers Should Know About Background Checks

Background checks allow companies to evaluate potential employees and assess whether a candidate is the right choice. As an applicant, it is important to understand the various laws and regulations you are protected by, as well as what information…

Be on the Lookout for Scams Around Tax Time

As the tax deadline creeps up on us, identity thieves continue to ramp up their efforts to take advantage of our personal information. Here are some tips on how to best protect yourself.

The Lure of Credit Cards – The Minimum Payment Trap

One primary factor contributing to the savings problem in America is the continued reliance on credit cards to purchase things one wants but does not necessarily need. Here is an example of the long-term impact of falling into the minimum payment tra...

Student Spending in College: A Beneficial Course in Budget Basics

One extracurricular activity that every student should master before heading off to college is personal money management. Typically, a student’s day-to-day spending is done on an ad-lib basis, meaning that overspending is the norm, rather than the ...

Six Ways a Budget Can Help Boost Your Savings

Students and young adults have all heard about the importance of developing a budget. But, do they know why a budget is so important? Or Perhaps they simply spend what they must and save whatever’s left over. In either case, given the limits of the...

How Many Cups of Coffee Do Americans Drink Each Day

Ever wonder what the typical coffee habits of U.S. adults are? Here we highlight the average number of cups of coffee Americans drink each day.

Coping with the Financial Challenges of Losing a Spouse

When you lose your spouse, evaluating your finances may take a back seat to more pressing concerns. But even amid the grief that accompanies the death of a loved one, it is important to assess your financial and legal situation to avoid making any ra...

Your Television Might Be Spying On You

Those internet-connected devices can be a gateway for hackers. We tend to think relaxing with our smart TV and favorite show wouldn’t necessarily be a security risk, think again.

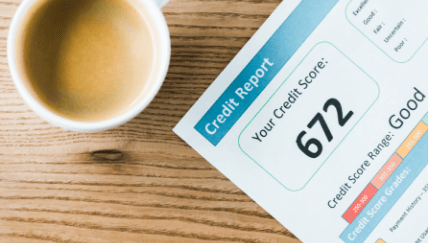

Keeping On Top Of Your Credit Rating

The use of credit in today’s world is pervasive. People charge meals in restaurants and purchases in boutique shops, pay for appliances on the installment plan and obtain loans to buy homes and automobiles, take vacations, and pay for schooling. Th...

Crack the Code on Credit Scores

We break down the factors utilized to calculate credit scores and the actions you can take that have the greatest impact. Maintaining a high credit score is essential to good financial health and can have long-term benefits.

10 Money Mistakes Millennials Should Avoid

Many millennials, even those with good educations and solid careers, are making financial mistakes. And some are making them over and over, digging a hole from which it may take years to climb out.

Education: One of the best Investments You Can Make

It wasn’t long ago when an individual went to college, got an education, and embarked on one career that usually lasted a lifetime. Many companies provided on-the-job training, and little emphasis was put on the idea of going back to school to cont...

America’s Fastest Drive-Thrus

In a hurry this weekend? Check out our list of America’s fastest drive-thrus to help ensure you’re not stuck in line the next time you are hungry.